Operating profit equation

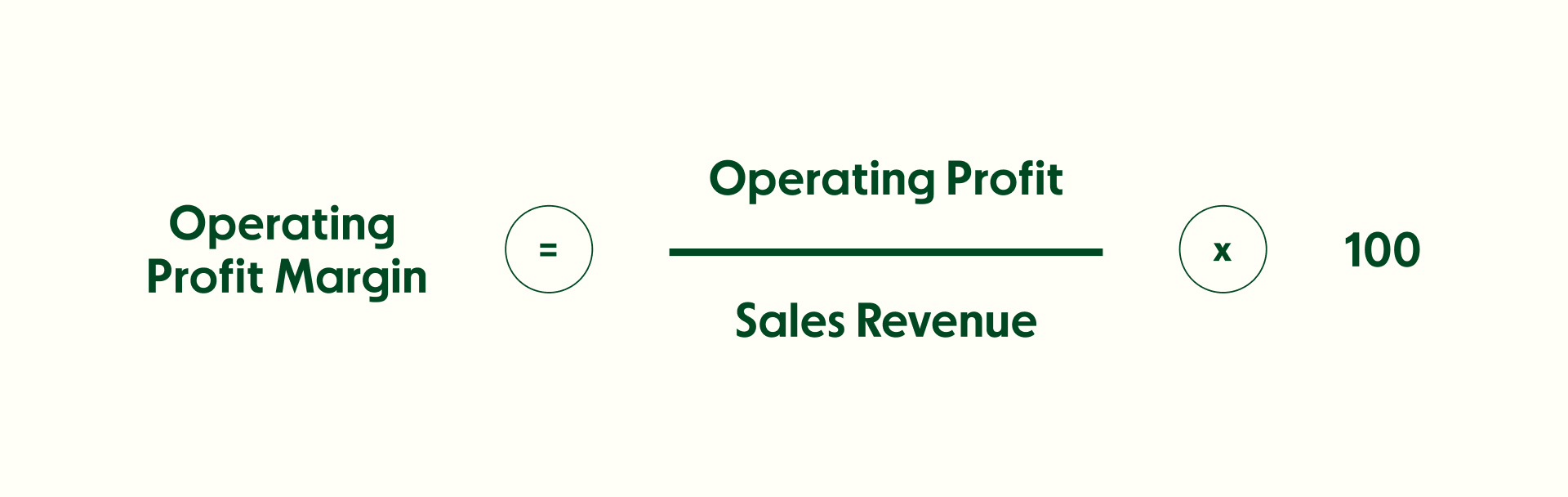

The operating profit equation is as follows. The sales to operating profit ratio compares a companys net sales to its operating profit.

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

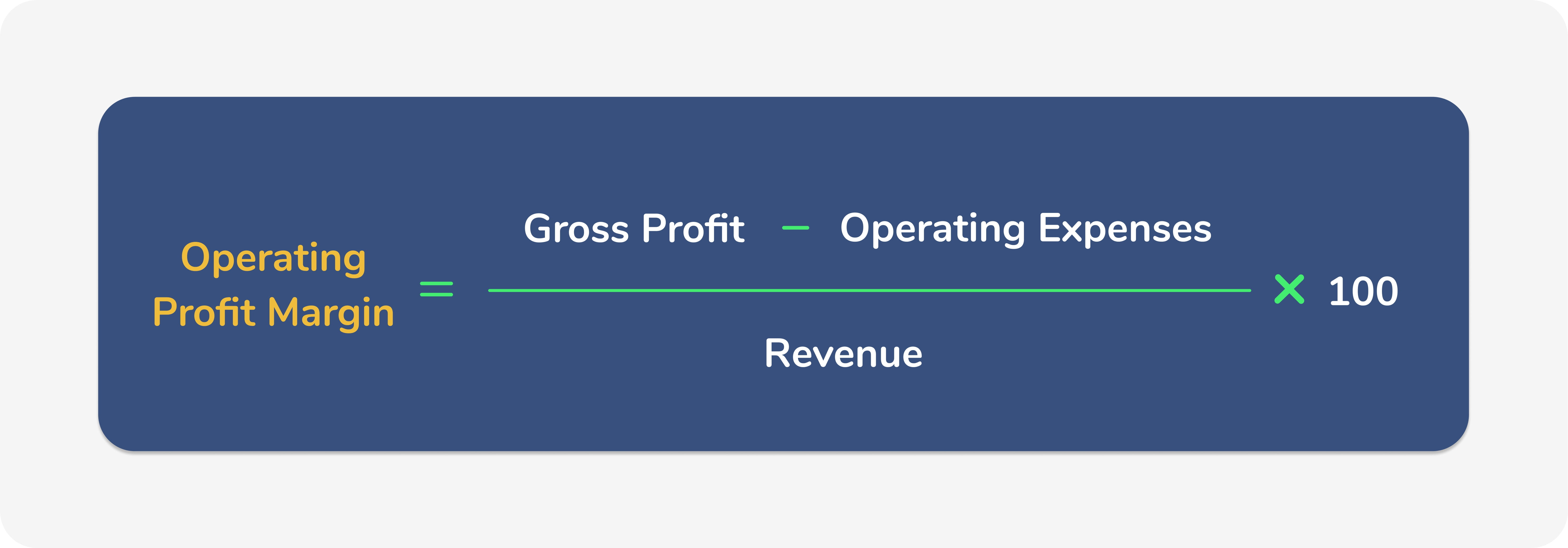

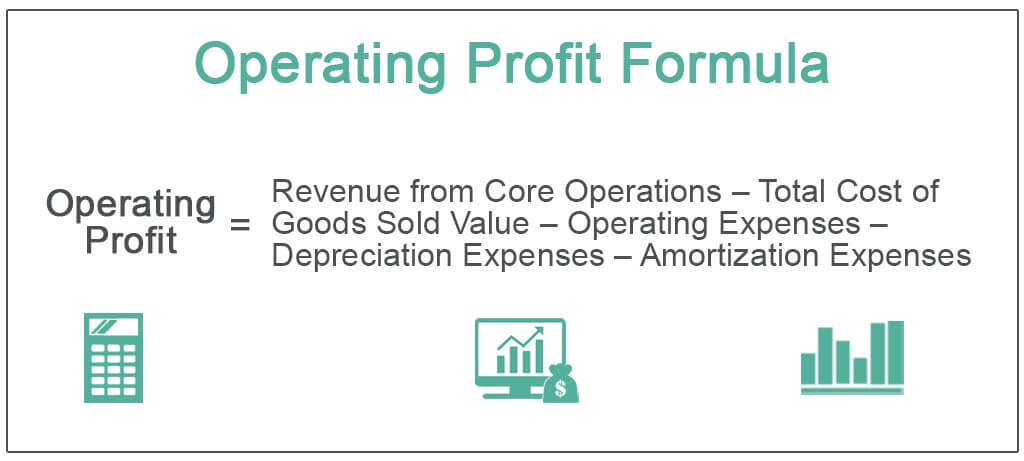

The formula for calculating operating profit is as follows.

. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating. Business owe Net Profit. Lets take a business that has a total revenue of 1 million.

Net profit equation The previous equations are ideal and provide. The formula is below and we cover operating profit in detail here. Costs of finance and any taxes the.

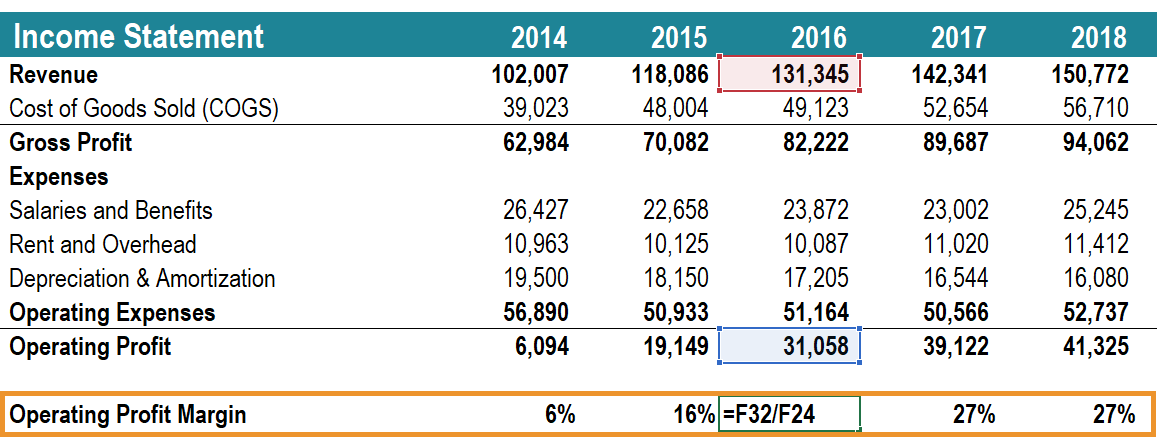

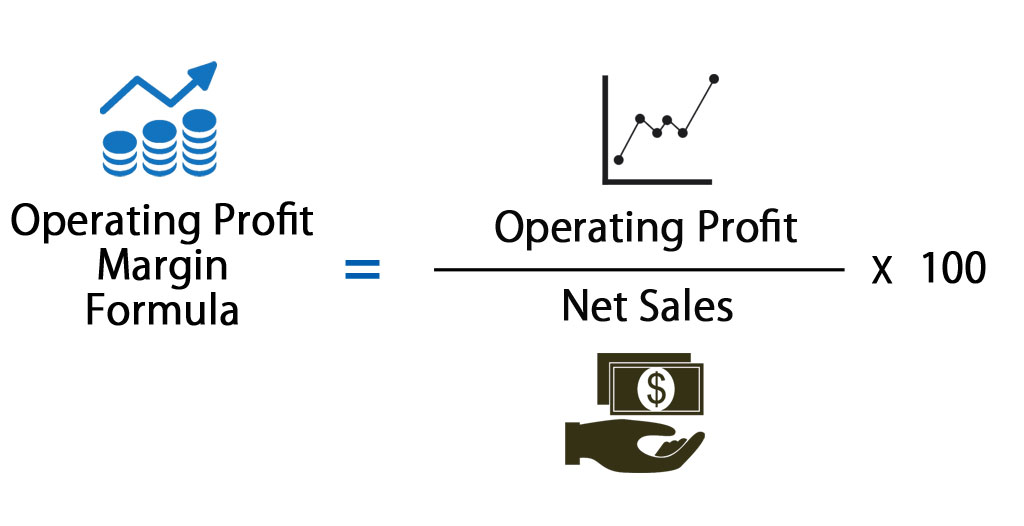

Operating profit 125000 85000 40000 Operating profit margin 40000300000 x 100 1333 Why is it important to know your Operating Profit Margin. Operating profit equation. Operating profit Revenue Direct costs Operating expenses The second method is to take the net profit.

Operating profit calculation example. Revenue Interest Tax ie. Net Sales The gross sales produced by a.

Its operating expenses are as follows. Operating profit or operating income is the amount of money your business earns after you deduct all the costs required to keep your business running. The easiest of the big three metrics is the gross.

10000 x 1 - 03. Operating profit operating revenue - cost of goods sold COGS - operating expenses - depreciation -. It demonstrates the financial sustainability of a companys basic operations prior.

NOPAT Example. What is the Operating Cash Flow Formula. Operating Profit Revenue Cost of Goods Sold COGS Operating Expenses Depreciation Amortization Given the gross profit formula Revenue COGS the operating profit formula is.

The operating profit ratio is the amount of money a company makes from its operations. Finally the operating profit offers an overview of a companys financial performance. For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation.

Operating Profit Margin Operating Income Revenue 100 3. Operating profit is calculated by subtracting all COGS depreciation and amortization and all relevant operating expenses from total revenues. How to Calculate Sales to Operating Profit Ratio.

Of fixed assets Operating profit. Operating Profit Revenue - Operating Expenses - Cost of Goods Sold - Other Day-to-Day Expenses eg depreciation amortization etc To use this formula to calculate the. In a few words it represents the total profit of a business.

Operating Profit

How Income Statement Structure Content Reveal Earning Performance Income Statement Cost Of Goods Sold Financial Statement Analysis

Operating Profit How To Calculate Operating Income

Gross Profit Accounting Play Accounting Medical School Stuff Accounting And Finance

Operating Profit Margin Learn To Calculate Operating Profit Margin

Return On Net Worth Accounting Books Accounting Principles Financial Management

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

Operating Profit Margin Definition Formula And Calculation Wise Formerly Transferwise

Understanding The Operating Profit Formula How To Calculate It

Operating Profit Formula How To Calculate Operating Profit

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Ebit Meaning Importance And Calculation In 2022 Bookkeeping Business Accounting Education Small Business Bookkeeping

Profit Margin Formula And Ratio Calculator Excel Template

Understanding Operating Margin

Gross Profit Accounting Play Medical School Stuff Accounting Basics Financial Analysis

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

Operating Profit Margin Formula Calculator Excel Template