26+ Total debt to income ratio

In middle income countries youth are more likely to be students wage employed or NEET in low income countries youth are more likely to be self-employed or underemployed. When analyzing the stock of debt the Bank considers highly indebted households to be those with a debt-to-income ratio greater than 350.

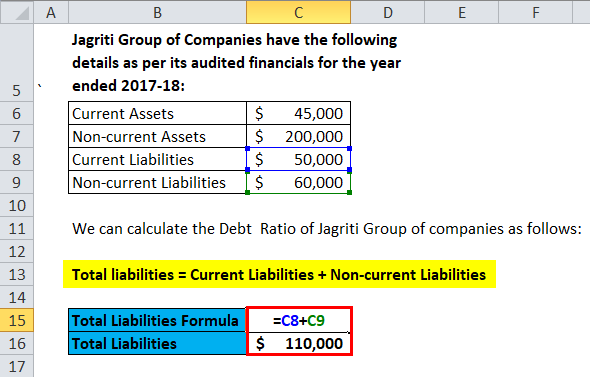

Debt Ratio Formula Calculator With Excel Template

While you can qualify for a mortgage with a debt-to-income DTI ratio of up to 50 percent for some loans spending such a.

. From independence in 1947 until 1991. The ratio of benefits to taxes is almost three times as high as it is for those in the top fifth. 26 simple charts to show friends and family who arent convinced racism is still a problem in America.

The debt-to-capital ratio is calculated by taking the companys debt including both short. Code 514 - Unrelated debt-financed income. For a sample of 26 African countries unweighted average tax-to-GDP ratios had remained stagnant at around.

2019 Low-income country debt. The number of new homes sold in 2007 was 264 less than in the preceding year. This metric enables comparisons of leverage to be made across different companies.

The debt ratio measures the weightage of leverage in the capital structure of a company. -1 Unrelated debt-financed. Debt Ratio Total Liabilities Total Assets.

The principal loan amount. Total assets are defined as the sum of. 1 In general At the election of the taxpayer income from the discharge of indebtedness in connection with the reacquisition after December 31 2008 and before January 1 2011 of an applicable debt instrument shall be includible in gross income ratably over the 5-taxable-year period beginning with.

4 time and savings deposits certificates of deposit and money market accounts. In 2023 total income and interest earned on assets are projected to no longer cover expenditures for Social Security as demographic shifts burden the system. By 2035 the ratio of.

Debt Service Coverage Ratio. 5 government bonds corporate bonds foreign bonds and other financial securities. It is the worlds fifth-largest economy by nominal GDP and the third-largest by purchasing power parity PPP.

172-3 Excludable amounts not income. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. This topic contains information on the use of the debt-to-income DTI ratio including.

Total monthly income of all borrowers to the extent the income is used to qualify for the mortgage see Chapter B33 Income Assessment. 6 the cash surrender value of life. A debt ratio of Anand Group of Companies is 036.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. Total national debt rose from 66 GDP in 2008 pre-crisis to over 103 by the end of 2012. Debt Ratio 036 or 36.

Car payments and student loan payments as well as your total monthly. Three key trends blog Overseas Development. The Debt service coverage ratio Debt Service Coverage Ratio Debt service coverage DSCR is the ratio of net operating income to total debt service that determines whether a companys net income is sufficient to cover its debt obligations.

1 the gross value of owner-occupied housing. The total monthly mortgage payment. Debt Ratio 90000 250000.

172-5 Expected return. 172-4 Exclusion ratio. The Institute reported on February 17 2010 that the average Canadian Family.

Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. The employment-population ratio measures the share of a demographic group that has a job. The DSR is divided into two parts.

Time Use by Country Income Level. Any chargeback referred to in the preceding sentence shall not be at a ratio in excess of the ratio under which the loss or income as the case may be was allocated. The ratio of household debt to disposable personal income rose from 77 in 1990 to 127 by the end of 2007.

As for the debt service we can see that it. 2 other real estate owned by the household. This is a different ratio because it compares a cashflow number yearly after-tax income to a static number accumulated debt - rather than to the debt payment as above.

Maximum DTI Ratios. 7982 Government debt may be owed to domestic residents as well as to. Maiores obstáculos às empresas na África subsariana.

Which bears the same ratio to the total amount of such expenditures as. Interest on a debt obligation which was part of an issue with respect to which an election has been made under subsection c. 172-18 Treatment of certain total distributions with respect to self-employed individuals.

This is in contrast to flow data mortgage originations for which the Bank defines the vulnerability as a loan-to. A deficit occurs when a governments expenditures exceed revenues. 26 12000 21 32 16 24 13000 19 29 15 22.

Stock of total external debt and debt service 2013. Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. The economy of India is a middle income developing market economy.

The debt-to-capital ratio is a measurement of a companys financial leverage. The business finance term and definition debt service coverage ratio DSCR is the ratio of cash your small business has available for paying or servicing its debt. The Vanier Institute of the Family measures debt to income as total family debt to net income.

Code 861 - Income from sources within the United States. Total external debt stocks of developing economies and economies in transition had more than doubled from USD 35 trillion in 2008 to USD 88. 81 Changes in government debt over time reflect primarily borrowing due to past government deficits.

172e-1T Treatment of distributions where substantially all contributions are employee contributions temporary. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. According to the International Monetary Fund IMF on a per capita income basis India ranked 142nd by GDP nominal and 128th by GDP PPP.

Of the total gross income derived during the taxable year from or on account of such property as A. Your mortgage property taxes and homeowners insurance is 2000. Debt payments include making principal.

The net operating profit is 21826 in the year 2018. 3 cash and demand deposits. Total debt to total assets is a leverage ratio that defines the total amount of debt relative to assets.

The Household Debt Service Ratio DSR is the ratio of total required household debt payments to total disposable income. A countrys gross government debt also called public debt or sovereign debt is the financial liabilities of the government sector. Percent Seasonally Adjusted Frequency.

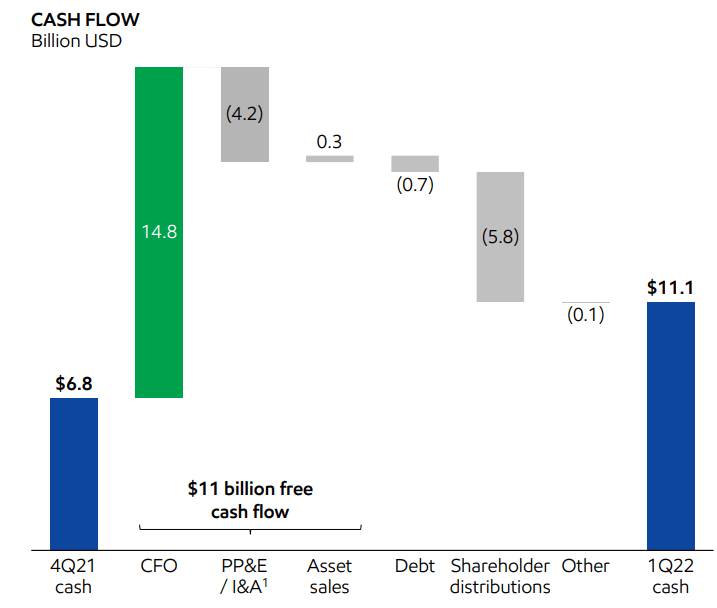

Ex 99 2

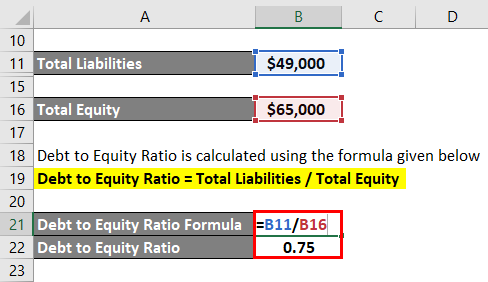

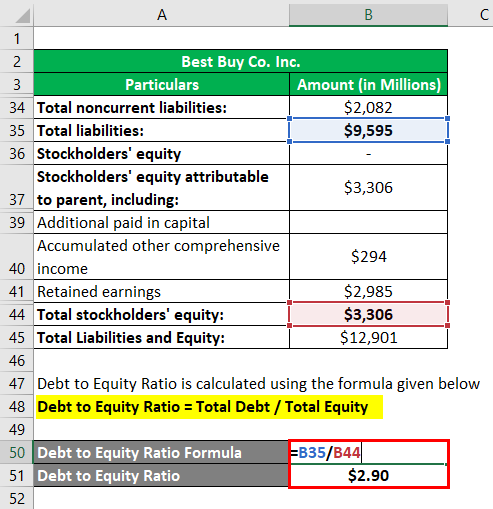

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Exxon Mobil Stock Buy The Drop Nyse Xom Seeking Alpha

Debt To Equity Ratio Formula Calculator Examples With Excel Template

How To Calculate Loan To Value Ratio Topic 11 Bankingtutorial Learn Banking With Easy Tips Youtube

Ex 99 2

Pin On Free Printables

Debt To Capital Ratio Formula Meaning Example And Interpretation Debt Raising Capital College Adventures

Debt Ratio Bookkeeping Business Financial Ratio Debt Ratio

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Debt Ratio Formula Calculator With Excel Template

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

Charts Visualizations Abi